Economy to have lasting effects on students’ budgets

Nathan Humpherys

Headlines about falling stocks and the credit crunch may seem like they have little relevancy to college students, but the current and upcoming national financial troubles could have major impacts on students.Students are notorious for having large amounts of debt. College education is expensive, and it is necessary for most students to take out loans for expenses, like tuition and books, they would not be able to otherwise afford.

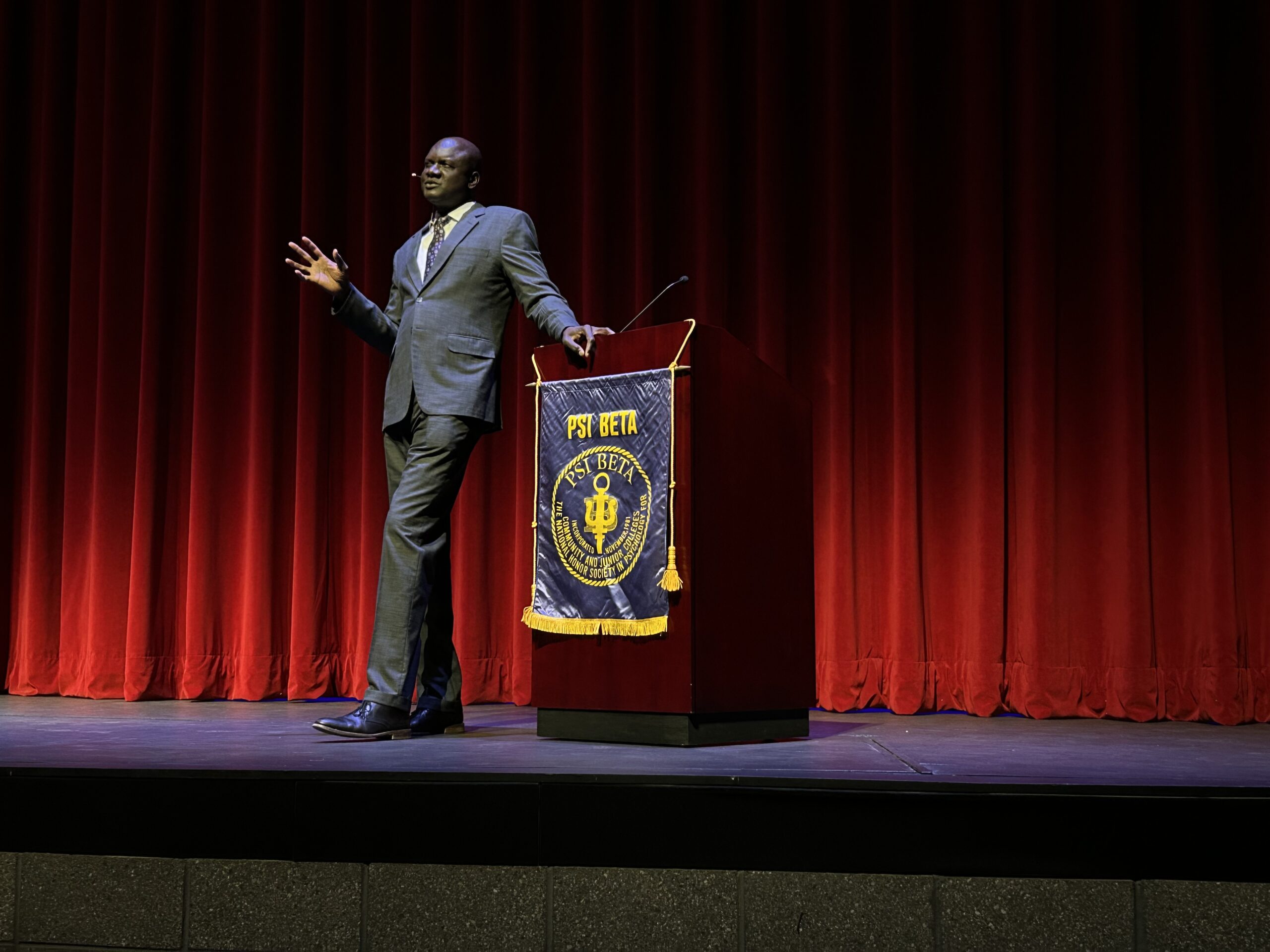

This is where the national economy comes into play. With banks unable to get short-term liquidity, money to invest in the short, they are unable to make long-term loans to customers Arizona State Treasurer Dean Martin said at a Oct. 20 presentation at MCC, where he explained the current economic situation.

Martin, along with virtually every other financial advisor, stressed the importance of students taking care of their credit and paying down debt.

Banks are very wary of risk, so the less debt and the higher the credit score, the better for students when they apply for loans for things they really need.

Even one missed or late payment can do serious harm to students’ credit scores, especially when most students haven’t had a long time to establish their credit history.

Not only will bad credit hurt when students want to take out student loans, but it’s also something many employers check, Martin said.

Martin added that employees with bad credit are higher risk employees and more prone to theft or mismanagement.

The key to having good credit is good financial planning, which helps people avoid situations that will hurt their credit scores.

The most important aspect of financial planning is a realistic budget.

Budgets should be written out, with liberal estimates of upcoming costs, based on what these expenses have added up to in the past.

A rainy day fund is essential in uncertain economic times, where no one is immune from layoffs, said Kathleen Pender, a financial columnist for the San Francisco Chronicle, in her online article, “Tips for Surviving a Recession.”

Pender suggests stocking away enough money so people can cover their expenses should they loose their source of income.

She also suggests three to six months living expenses to be put away in an emergency fund, a hard goal for students who aren’t financially established, but one month’s expenses might be achievable.

Paying down debts, especially credit cards is also important, Pender said. She also stresses that any monthly payment students have to make ties up funds that could otherwise be spent on other expenses or a rainy day account.Not to mention, should students find themselves without a job or having to cut their hours, the more reoccurring monthly bills they have, the harder it’s going to be to downsize their living to fit their income.

Students should refer to their budget when looking for places to cut expenses so they can have money to save for a rainy day fund or pay off credit cards.

Pender stressed the importance of not spending impulsively, something people tend to do to escape the stress of difficult times.

Before going shopping anywhere, students should make a list of what they need and stick to it, even for products that claim to help minimize expenses, and put off bigger expenses, like a new car or stereo system, as long as possible.

Students should also consider paring down entertainment expenses by cutting back on eating out and pre-made meals, which cost more than fixing dinner. Students should also look at their short-term and long-term careers, and look into further training or changing to less at-risk careers or majors.